The landscape of sustainable investing in Australia is evolving rapidly, presenting both challenges and opportunities for financial advisers. Political disputes, greenwashing concerns, and increasing regulatory demands have been significant hurdles, yet our commitment to sustainability remains unwavering. At Oko Adviser, we believe that integrating sustainability analysis is crucial for understanding a company’s stakeholder relationships, exposure to emerging social and environmental issues, and adaptability. This focus on sustainability isn’t just a trend; it’s a core component of long-term investment strategy.

1. Transitioning from ESG Integration to Sustainable Themes

Investors are moving beyond the basic integration of environmental, social, and governance (ESG) factors to embrace more specific, thematic approaches to sustainable investing. Our research shows a growing interest in long-term trends reshaping the global economy, particularly among Australian investors. The 3D Reset1—demographic changes, deglobalization, and decarbonization—drives this shift. For instance, investors are increasingly focusing on companies leading the transition to renewable energy. They are also looking for substantial social and environmental impacts alongside financial returns, facilitated by better impact measurement and access to a wider range of asset classes.

2. Sustainability as a Core Challenge in the 3D Reset

The sustainable themes of decarbonization, deglobalization, and demographic changes have significant business implications. Companies must adapt their business models to changing demographics, manage supply chain pressures, and meet net-zero commitments. These sustainability considerations are crucial for assessing business viability and ensuring long-term investment security.

3. Deepening Understanding of the Energy Transition

The energy transition is more than just expanding renewable energy capacity; it requires significant investment in infrastructure to avoid grid congestion and enhance energy efficiency in buildings. It also involves shifting from a linear “take-use-discard” model to a circular “recycle” economy. COP28, the 2023 UN Climate Change Conference, set ambitious goals to triple renewable energy capacity and double energy efficiency improvements by 2030. Achieving these goals requires substantial investment and policy support.

4. Increasing Recognition of Natural Capital’s Value in Climate Change

Political discussions are increasingly linking nature and climate issues. Investment in nature is a cost-effective way to reduce global emissions, yet nature-based solutions attract only a small fraction of climate finance. Establishing a consistent global framework for carbon trading is essential to unlocking the potential of natural capital. COP28 highlighted nature-based solutions, with commitments to fund initiatives supporting forests, mangroves, and oceans. Coordinating nature and climate strategies will be crucial moving forward.

5. Overcoming Persistent Challenges Amid the Need for Committed Action

Economic and financial stress in many countries, along with cost-of-living challenges, have delayed climate action. The UN’s 2023 Global Stocktake report indicates that efforts to mitigate global warming are insufficient. Achieving the Paris Agreement’s goals requires significant emission reductions and a commitment to substantial policy changes from global leaders. Clear signals from governments about their commitment to climate action will help financial markets identify beneficiaries and losers in this transition. At Oko Adviser, we manage portfolios with these risks and opportunities in mind.

6. Emphasizing Fundamentals in Climate Impact Understanding

Understanding the impact of climate transition on companies and whether their valuations reflect the associated risks or benefits is crucial. The recent contraction in valuations of clean technology sectors underscores the need for selectivity in climate investing. Identifying businesses poised to benefit from structural growth in this market will be increasingly important.

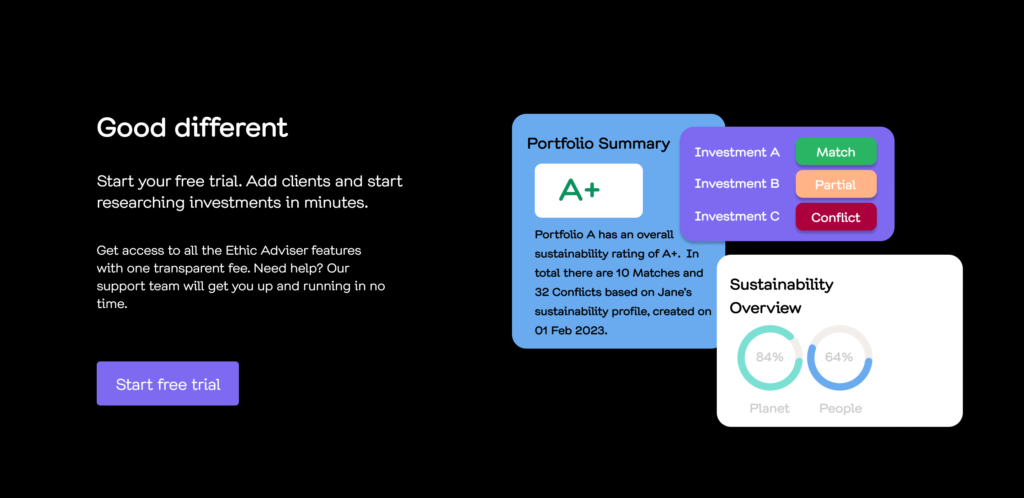

7. Heightened Attention to Sustainability Amid Australian ESG Politicization

Despite the politicization of sustainability in Australia, especially during an election year, the need for ESG consideration remains. Pension plan sponsors across all states must address ESG factors from a financial materiality standpoint while focusing on beneficiaries’ best interests. We anticipate further regulatory solidification in 2024, leading to increased ESG disclosure and better investment decision-making. Sustainability as an investment discipline will persist and mature. Passive approaches that conflate “ESG” with specific sectors are likely to give way to more targeted thematic and impact approaches. Australian investors continue to see value in sustainability and impact strategies, recognizing their importance for long-term financial returns.

Conclusion

As the understanding of sustainability matures, investors are increasingly interested in thematic approaches that target long-term global economic themes, such as decarbonization. These trends present real investment opportunities and the potential to build more resilient portfolios. At Oko Adviser, we are committed to meeting investors’ demand for sustainable investment options and supporting transition planning and net-zero implementation. Our advanced AI and profiling tools provide detailed sustainability assessments, identify emerging risks and opportunities, and offer tailored investment strategies. This enables investors to make informed decisions, align their portfolios with long-term sustainable trends, and achieve their financial and environmental goals more effectively.

Stay ahead with Oko Adviser, where sustainability meets strategic investment.

- https://www.schroders.com/en-us/us/individual/3d-reset/ ↩︎