In the ever-evolving landscape of finance and sustainability, a recent report has sparked a blaze of controversy. Market Forces, an environmental advocacy group, has lifted the veil on Australian superannuation funds, revealing a startling trend: a doubling of investments in fossil fuel companies over the past two years, whilst reducing investments in green energy by half a billion dollars.

While the world clamors for cleaner, greener energy solutions, Australian super funds seem to be marching to a different beat. According to Market Forces’ latest analysis, these financial behemoths have poured a staggering $39 billion into what they term “climate wreckers.” This figure, up from $19 billion in 2021, paints a disconcerting picture of misplaced priorities in our investment landscape. And to add fuel to the fire, clean energy investments have seen a decline, falling to $7.7 billion over the same period.

The dissonance between words and actions is stark. Despite espousing support for climate action, most super funds appear to be bolstering the very industries driving environmental degradation. Brett Morgan of Market Forces rightly points out the hypocrisy, noting that super funds must walk the talk by compelling fossil fuel companies to halt their expansion plans and publicly divest from them. Failure to do so, Morgan argues, amounts to nothing short of greenwashing.

But amidst the gloom, there’s a glimmer of hope. Market Forces’ tireless advocacy has galvanized public support, compelling many super funds to up their climate game in response to member pressure. This underscores the power of collective action in holding financial institutions accountable for their investment decisions.

Yet, behind the eye-catching headlines lies a troubling truth: a handful of companies are reaping the lion’s share of these investments, driving the expansion of fossil fuel projects. Woodside, Santos, and Whitehaven emerge as the key beneficiaries, with Woodside alone constituting a whopping 20% of the investment value of AustralianSuper, the nation’s largest super fund.

As the spotlight intensifies and regulatory scrutiny tightens, the question looms larger than ever: where do our financial allegiances truly lie? The recent legal action by ASIC against Mercer Superannuation for alleged greenwashing serves as a sobering reminder of the need for transparency and accountability in sustainability-related claims. In this era of heightened environmental consciousness, super funds stand at a crossroads. Will they continue down the path of short-sighted profit-chasing, or will they heed the call for genuine stewardship of our planet’s future? The answer lies not just in lofty promises but in concrete actions to divest from fossil fuels and embrace a truly sustainable investment ethos. The choices made today will shape the landscape of tomorrow.

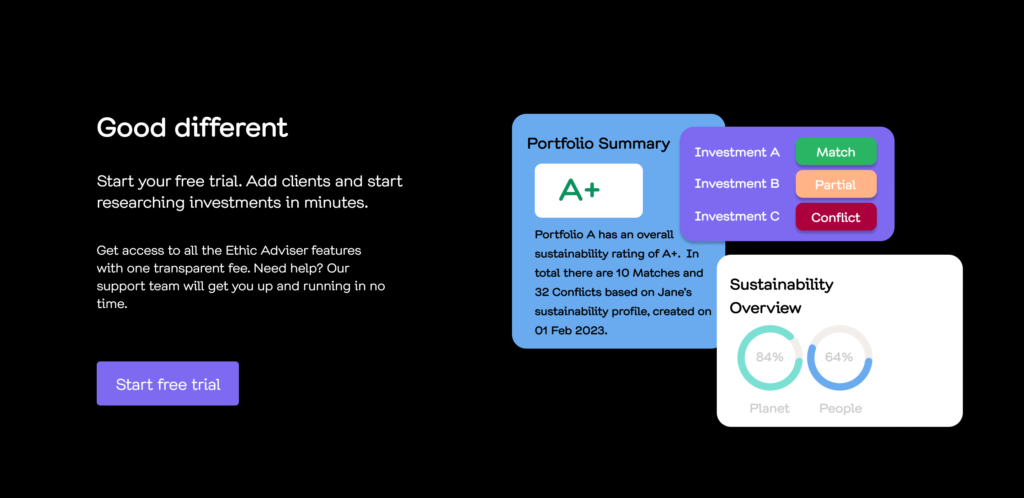

For Advisers looking to cut through the noise of lofty statement and action, Oko Adviser provides details analysis at a holdings level of most major Super funds and funds. The analysis is driven by what a client wants when it comes to sustainability, giving you the confidence that investment recommendations are aligned to client needs.